Nanak-Nasim's different campaign strategy

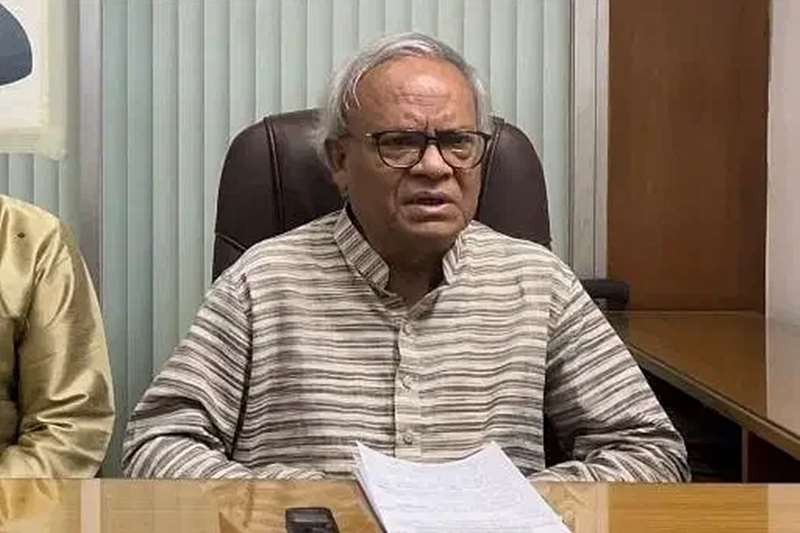

Jahangir Kabir Nanak and AFM Bahauddin Nasim

12th National Parliament elections have been boycotted by opposition political parties including BNP. In this situation, many people feel that attracting voters to the Center will be a big challenge.

Apart from campaigning for the election, the candidates are adopting various tactics to attract voters. One such strategy is ‘QR Code’. This is a new addition to the posters of at least two seats in Dhaka during the election campaign. Both candidates have added quick response codes or 'QR codes' to their posters.

By scanning the 'QR code' given on the poster with the mobile phone scanner, voters will get information about their respective polling stations.

boat's two candidates are - Awami League's presidium member Jahangir Kabir Nanak, candidate for Dhaka-১৩ seat, and party's joint general secretary AFM Bahauddin Nasim, candidate for Dhaka-8 seat.

By scanning the 'QR code' given on the poster containing pictures of eyes and nose, voters will get information about their respective polling stations by scanning with the mobile phone scanner.

In this regard, Jahangir Kabir Nanak said, that we should always think about the additional benefits of every voter. As if they can vote without any hindrance. A voter will know at which centre he will vote and also about the candidate. You can know this information by using this QR code.

And AFM Bahauddin Nasim said, that through the use of a QR code, voters will be able to know the information about the polling station as well as the candidates. That's why we used this poster.

পাঠকের মন্তব্য